Jerald Finney

Copyright © Ausust 13, 2014

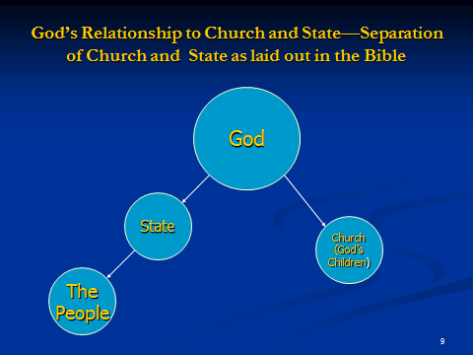

Some churches proudly proclaim that they are not 26 U.S. Code (Internal Revenue Code (“IRC”)) § 501(c)(3) (“501c3”) churches while they are in reality churches which are effectively the same as 501c3 churches. Many of these churches repeat the words of IRC § 501c3 in one or more of their corporate documents, thereby avoiding the necessity of filling out Form 1023 in order to obtain their 501c3 tax exempt status. They become 501c3 churches without doing anything other than incorporating. They can do this because of 26 U.S. Code § 508 (“508”). (Remember, to check what the author is saying about a code, one can go directly to any referenced material which is in blue simply by left clicking). 508(a) declares that “New organizations must notify Secretary that they are applying for recognition of section 501(c)(3) status.” 508(c)(1)(A) however, declares that churches are mandatory exceptions to this rule. No doubt the drafters of the Internal Revenue Code were aware of the First Amendment, so they included 508(c)(1)(A), even though 508(c)(1)(A) violates the First Amendment religion clause, which says, “Congress shall make no law respecting an establishment of religion, or prohibiting the free exercise thereof.” 508(c)(1)(A) is obviously a law made by Congress; 508(c)(1)(A) is both a law respecting an establishment of religion, and as will be shown below, prohibits the free exercise thereof. Of course, almost no pastor realizes how he is being deceived into violating the First Amendment religion clause which is simply a law declaring the biblical principle of separation of church and state. I explain the last statement in many of my writings and teachings – You may find very helpful, as a starting point, the article “Is Separation of Church and State Found in the Constitution?“

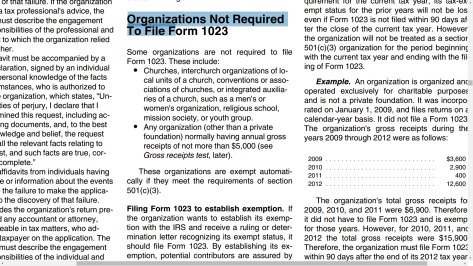

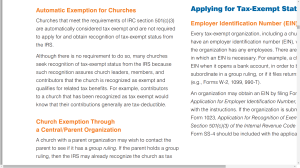

The IRS publicizes their interpretation of IRS Code. On page 3 of IRS Publication 1828 states that “churches which meet the requirements of § 501(c)(3) are automatically considered tax exempt and are not required to apply for and obtain recognition of tax-exempt status from the IRS” [Bold emphasis mine]. The IRS repeats this on page 24 of IRS Publication 557, “Tax-Exempt Status for Your Organization.”Under the heading “Organizations Not Required To File Form 1023” churches are listed.” The following paragraph is included: “These organizations are exempt automatically if they meet the requirements of section 501(c)(3).” A church which meets the requirements of 501(c)(3) is – by the rules which are included therein and also by the rule against doing anything that violates fundamental public policy which was added by the IRS, not by law, and upheld by the United States Supreme Court – is thereby prohibited from freely exercising her religion because she is prohibited from doing and saying certain things.

Pastors and others who mislead their flocks on these and other issues are wolves in sheeps clothing. When a church yokes up with unbelievers in any way, including yoking up with and submitting herself to the government agencies and courts, that church fellowships with unrighteousness, communes with darkness, and agrees with idols. The biblical principle of separation comes into play and believers in that church should leave her and find a New Testament church:

2 Corinthians 6:14-18: “Be ye not unequally yoked together with unbelievers: for what fellowship hath righteousness with unrighteousness? and what communion hath light with darkness? And what concord hath Christ with Belial? or what part hath he that believeth with an infidel? And what agreement hath the temple of God with idols? for ye are the temple of the living God; as God hath said, I will dwell in them, and walk in them; and I will be their God, and they shall be my people. Wherefore come out from among them, and be ye separate, saith the Lord, and touch not the unclean thing; and I will receive you, And will be a Father unto you, and ye shall be my sons and daughters, saith the Lord Almighty.”

See other writings and teachings on this website, opbcbibletrust.wordpress.com, for thorough biblical, legal, and historical analyses of all issues concerning church coporate 501(c)(3) (“legal entity”) status. A companion article to this article is “Church Internal Revenue Code 508 Status.”