Jerald Finney

Copyright © April, 2010

Contents:

Preface

I. Preface

II. Introduction

III. The Spirit Filled Walk of the Believer and of God’s

Churches and the greatest Commandment

IV. The love relationship between Christ and His

churches

A. Practical experience demonstrates the love

relationship between Christ and His churches

B. Old Testament insights concerning the marriage

relationship between Christ and His churches

C. Additional New Testament insights into the love

relationship between Christ and His churches

D. A I Corninthians 13 analysis of the love

relationship between Christ and His churches

IV. Conclusion

Preface

This is a teaching and helps ministry motivated by love: love for our Lord first, and love for others second. I can find no more important subject than the love relationship between Christ and His children and Christ and His churches. Since I am convinced that this is a God-called ministry, I conduct this ministry at my own expense. I do not wish to dishonor my Lord by seeking worldly gain or riches through this ministry or by teaching heresy. Since I am not paid, nor do I seek to be paid for my work in this ministry, I will be convinced only by solid biblical reasoning. In other words, no one can buy me since my Lord, and my Lord only, has paid it all. My highest allegiance is to Him.

If you can disprove what I am teaching, you have an obligation—to God first, and to your brother in Christ second—to correct me. I will not accept conclusory statements backed up by nothing. I will only accept Holy Spirit guided insights based upon biblical principles and the application of legal and historical facts to those principles. If you prove me wrong, I have an obligation to repent, ask your forgiveness, and correct my teachings. If what I am saying is true, you have an obligation to God to conform your actions to God’s principles, including, if need be, repenting and reorganizing your church according to the principles of God.

I. Introduction

Many churches, even “Bible believing churches” with saved pastors and members, state that the salvation of souls (witnessing to others in order to lead them to salvation) is more important than making sure that a church is not entangled with the civil government. Of course, salvation of souls is very important. The Great Commission is still in the Bible; but so is the principle that God desires His people and His churches to love Him. In fact, loving God is the greatest commandment. Loving God, according to the Bible is more important than loving one’s neighbor. However, if one loves God, he will love his neighbor. Please continue reading to the end to see how the Word of God makes this clear. Should you disagree with me, please contact me and give me the biblical basis for your disagreement. If God’s people and God’s churches love God first, many more souls will be saved, since churches who love God will have the power of God rather than a form of godliness.

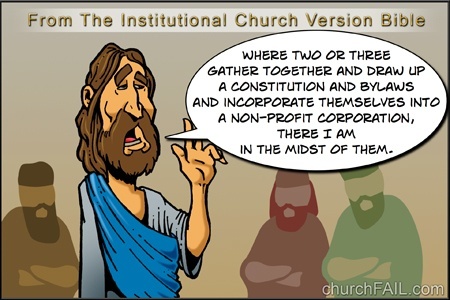

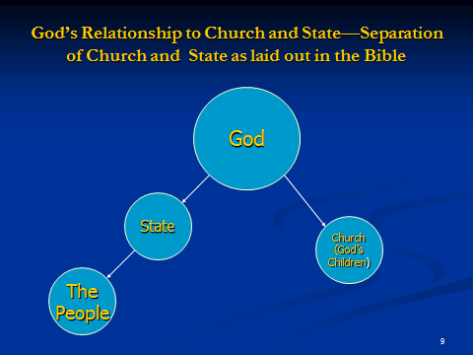

Of course, churches (not to speak of individuals and families) dishonor their love relationship with Christ in many ways. My ministry is primarily concerned with a much neglected and egregious sin of churches as to their relationship with Christ—the union of churches with civil government through incorporation, unincorporated association status, corporation sole, and Internal Revenue Code Section 501(c)(3) tax exempt status.

I have addressed the biblical principles and the facts concerning legal entities and 501(c)(3) in books, articles on this “Separation of Church and State” blog, and audio teachings. This article is concerned only with the most important of the many sub-issues which must be developed to fully understand the issue of the God-desired relationship between church and state. What does it mean for a church to love God? How does a church demonstrate that she loves God or not? Other sub-issues—such as the God-given definition, purposes, and organization of a church—are covered in God Betrayed/Separation of Church and State: The Biblical Principles and the American Application (For free audio teaching on the book, click this link: “Free abridged audio of God Betrayed;” to order the book, click the following link: “Books”. Click the following link to preview God Betrayed: Link to preview of God Betrayed.).

Application of biblical principles to incorporation, other methods of making a church a legal enitity, and Internal Revenue Code § 501(c)(3) tax exempt status makes clear that churches who become legal entities such as corporations and get 501(c)(3) status violate several biblical principles including the principle of separation of church and state, thereby dishonoring the love relationship between Christ and His church. Nonetheless, many churches use the excuse that the most important thing is winning souls to justify proceeding in the flesh and dishonoring their love relationship between Christ and His church by incorporating and obtaining 501(c)(3) status or by not reorganizing according to Bible principles when the church already has legal entity status. However, as the Word of God teaches and reality reveals, corporate (includes corporation sole) 501(c)(3) churches and churches which are legal entities of other types become more and more anemic with the passing of time. They do this because they resort to anti-biblical devises and place themselves at least partially under another sovereign and the anti-biblical rules of that sovereign

III. The Spirit Filled Walk of the Believer and of God’s

Churches and the Greatest Commandment

Just as it is important for a family to understand God’s definition, purposes, and principles for family, so it is important that a church family understand the God-given definition, purposes, and principles for a church and her members in order to fully understand and apply the biblical principle of separation of church and state. Very importantly a New Testament church is a purely spiritual entity made up of saved individuals who are instructed to walk in the spirit. A church will be spiritual only to the degree that the members, individually and as a church, walk in the spirit. Part of the walk of believers requires them to make sure that the church they are members of continues to organize and operate according to New Testament principles as spiritual entities only, not as earthly legal entities.

Scripture teaches that the most important thing for a church is the love relationship between Christ and His churches. Nothing a church can do overrides the importance of honoring that relationship. Jesus responded to

“[a] lawyer, [who] asked a question, tempting [Jesus], and saying Master, which is the great commandment in the law? Jesus said unto him, Thou shalt love the Lord thy God with all thy heart, and with all thy soul, and with all thy mind. This is the first and great commandment. And the second is like unto it, Thou shalt love thy neighbour as thyself. On these two commandments hang all the law and prophets” (Mt. 22.37-40. See also, Mk. 12.28-34 and Lu. 10.25-28 (Mk. 12.28-34 and Lu. 10.25-28 add loving God with “all thy strength” along with “all thy heart, soul and mind” to the greatest commandment.”)). These commandments were also stated in the Old Testament (See, e.g, De. 6.5 and the Ten Commandments in Ex. 20.1-17).

Most believers will agree with the principle (How can believers who have even a rudimentary knowledge of God’s Word deny this?). Sadly, many miss the mark in the definition and application of love since they have not studied and meditated on relevant biblical teachings and applied them in the real world.

The Bible teaches that loving God first will result in loving one’s neighbor by witnessing to him, helping him, sending missionaries to him, etc. When one loves God with all his heart, soul, mind, and strength, loving one’s neighbor comes naturally and “is like unto [loving God]” (Mt. 22.37-39; Lu. 10.27; Mk. 12.29-31). One who loves God with all his heart, soul, mind and strength will carry out the Great Commission, seek to lead others to salvation, disciple believers, help his neighbors, and walk in the spirit individually and as a church (keep his church body a spiritual entity subject only to the Lord Jesus Christ).

However gifted, moral, or refined, the natural man is absolutely blind to spiritual truth, and impotent to enter the kingdom; for he can neither obey, understand, nor please God because he is not born again and the Spirit of God does not dwell within him. “Jesus answered and said unto him, Verily, verily, I say unto thee, Except a man be born again, he cannot see the kingdom of God. Jesus answered, Verily, verily, I say unto thee, Except a man be born of water and of the Spirit, he cannot enter into the kingdom of God. That which is born of the flesh is flesh; and that which is born of the Spirit is spirit” (Jn. 3.3, 5, 6).

Only believers are indwelt by the Holy Spirit. “Hereby know we that we dwell in him, and he in us, because he hath given us of his Spirit” (I Jn. 4.13). Only one who has the Spirit of God dwelling in him can love God. This does not mean that such a person actually loves God, at least with all his heart, soul, mind, and strength. It does not mean that a believer walks in the spirit (See Jn. 6.63; Ro. 8.1-13; Ga. 5.16-25; Ep. 5.1-17). Positionally, when one is saved, in the reckoning of God, the old man is crucified, and the believer is exhorted to make this good in experience, reckoning it to be so by definitely “putting off” the old man and “putting on” the new (Col. 3.8-14; Ep. 4.24). “And be renewed in the spirit of your mind; And that ye put on the new man, which after God is created in righteousness and true holiness” (Ep. 4.23-24). The fruit God desires from Christians is spiritual. “But the fruit of the Spirit is love, joy, peace, longsuffering, gentleness, goodness, faith, Meekness, temperance: against such there is no law” (Ga. 5:22-23).

As has been pointed out, born-again believers are instructed to love God with all their heart, soul, mind, and strength. In God’s point of view, doing for others may help a person and make his live temporarily happier, but the Word of God teaches that doing for others is not love if one does not love God. The lost man does not know or love God, and he has no clue as to eternal matters. The natural man can only impart earthly, temporal help to others. Although this is not in and of itself a bad thing, this alone—from God’s point of view—is not love.

God is, and He desires His children to be, primarily concerned with the spiritual, the eternal. “While we look not at the things which are seen, but at the things which are not seen: for the things which are seen are temporal; but the things which are not seen are eternal” (II Co. 4.18). Only the saved man can offer anyone eternal hope in addition to helping him with temporal matters (see I Co. 2.1-16). One who loves God first will love and serve his fellow man as to eternal matters first, and temporal matters second; helping others without loving God first is not loving others from God’s eternal spiritual viewpoint.

If one loves, God dwells in him, and he will be a light to others. “No man hath seen God at any time. If we love one another, God dwelleth in us, and his love is perfected in us” (I Jn. 4.12). “And we have known and believed the love that God hath to us. God is love; and he that dwelleth in love dwelleth in God, and God in him” (I Jn. 4.16). “For God, who commanded the light to shine out of darkness, hath shined in our hearts, to give the light of the knowledge of the glory of God in the face of Jesus Christ” (II Co. 4.6).

IV. The Marriage Relationship between Christ and His Churches

Christ is the Bridegroom/Husband/Head of His churches. As to the issue of separation of church and state, this is particularly important. The church is called the bride of the Lamb (Jn. 3.28, 29). The church is “married” to Christ. “Wherefore, my brethren, ye also are become dead to the law by the body of Christ; that ye should be married to another, even to him who is raised from the dead, that we should bring forth fruit unto God” (Ro. 7.4). Christ wants to be the only Head of His churches (Ep. 1.22; 5.23-33; Col. 1.15-18).

The apostle Paul, from whom Christians are given almost all doctrine of the church, was very concerned about the spiritual status and fruit of God’s churches. Paul spoke of the church as the virgin espoused to one Husband, and reveals that Eve is a type of the church as bride and wife of Christ. Paul said to churches, “I am jealous over you with godly jealousy: for I have espoused you to one husband, that I may present you as a chaste virgin to Christ” (II Co. 11.2). Because of this jealousy over Christ’s church, Paul feared, “lest by any means, as the serpent beguiled Eve through his subtilty, so [the minds of church members] should be corrupted from the simplicity that is in Christ” (II Co. 11.3).

God, as revealed by the apostle Paul, likens the marriage relationship of husband and wife to the relationship of Christ and His church:

“For the husband is the head of the wife, even as Christ is the head of the church: and he is the saviour of the body. Therefore as the church is subject unto Christ, so let the wives be to their own husbands in every thing. Husbands, love your wives, even as Christ also loved the church, and gave himself for it; That he might sanctify and cleanse it with the washing of water by the word. That he might present it to himself a glorious church, not having spot, or wrinkle, or any such thing; but that it should be holy and without blemish…. For no man ever hated his own flesh; but nourisheth and cherisheth it, even as the Lord the church: For we are members of his body, of his flesh, and of his bones. For this cause shall a man leave his father and mother, and shall be joined unto his wife, and they two shall be one flesh. This is a great mystery: but I speak concerning Christ and the church. Nevertheless let every one of you in particular so love his wife even as himself; and the wife see that she reverence her husband” (Ep. 5.23-27, 29-33).

A. Practical Experience demonstrates the love

relationship between Christ and His Churches

The Bible tells believers how God feels concerning certain actions of His churches. The Husband-wife and Bridegroom-bride analogies depicting Christ and His churches have important implications. From the Husband-wife analogy, we know that Christ, likened to a husband, wants to be over His wife, the church, in all things; and He is jealous when His wife, even if remaining for some purposes under Christ, also puts herself under another head or chooses to enter into a relationship with any other entity. God obviously wants us to know how important this relationship is and how God feels when a church dishonors that relationship. New Testament teaching concerning the relationship of Christ and His churches (as we have already seen and will examine more infra), practical experience regarding the husband-wife relationship of man and woman as analogized by God to the marriage of Christ and His churches, and Old Testament passages concerning the Husband-wife relationship between God the Father and Israel reveal to the believer how God feels about the relationship of Christ and his churches.

Concerning practical experience, what godly husband would not be jealous if his wife came to him, arms around another man, and said:

“You know that I love you very much. I appreciate your love for me and all you do for me. I have entered into an agreement with Joe. I want you to know that I have decided that I am going to meet with Joe a couple of times a week for breakfast, or lunch, or dinner; and maybe occasionally meet with him just to talk. He cares for me, and he can give me additional advice and information which will be very helpful to me and which you are not able to give, although the advice you do give is most appreciated and helpful as far as it goes and as far as it is correct. He will also help me financially, since you cannot give me all that I need and want. I will still love and honor you. I know that my relationship with Joe will be alright with you.”

How would a husband feel about such an arrangement? Would it affect the marriage in any way? Would not it affect the way the husband and wife treat and respond to one another? Would the husband be jealous? In many such situations, would not the result be a ruined marriage and family? Thus God’s Word uses reality to reveal to us that Christ is jealous over His church and is grieved when His spiritual wife puts herself under the state through incorporation and 501(c)(3) tax exempt status or in any other manner. (See God Betrayed, Section VI and/or Jerald Finney, God’s Churches: Spiritual or Legal Entities? (Austin, TX: Kerygma Publishing Co., 2009; these books are summarized in the audio teachings found on the following link: “Articles and audio teachings.”) for a thorough explanation of the incorporation and 501(c)(3) tax exemption of churches).

What happens when a wife starts to have an affair, even a non-sexual affair? She may be able to hide her earthly affair from her husband, but she cannot hide the effects of the affair. (Of course, a church cannot hide her affair from the Lord.) The attitude, speech, and actions of the wife change. Her relationship with her husband changes. Her husband now has to share his time with another who is partially over his wife. Joy leaves the marriage. Many times, if she does not repent, the marriage is destroyed. Even if she repents, she and her husband will never forget. Hopefully, he will forgive.

In many ways, it is the same with the local assembly that enters into an unholy union with the civil government. Many times, the church who does so tries to minimize the dishonor and grief she has caused her Husband, the Lord Jesus Christ. Many of those who even think about the possible implications of what they have done say, “Well, if my new partner ever tells me that I cannot preach salvation, he will have gone too far.” The pastor and members of such a church actually, if not knowingly, are saying by their actions:

“The Lord and his ways are not sufficient. The civil government takes better care of me than does the Lord. Civil laws are wiser and more beneficial than the precepts of the Word of God. The civil government protects the church, allows the church to enter into contracts, gives the church limited liability, gives the church tax exemption (not realizing that God makes the church non-taxable which is not good enough), allows my people to deduct their contributions, etc.”; or

“Romans 13 requires a church to incorporate and get 501(c)(3) status (click the following link for an article which addresses this argument: “American Abuse of Romans 13.1-2 and Related Verses.“).

Any rationale given to justify a union of church and state is spurious, and the Christian who offers such reasoning either does not understand or ignores the Word of God in these matters. He does not understand that God instructs him that the Lord is to be the only Head over His churches, that he is at the very least combining the holy with the unholy, or that he is at worst committing spiritual adultery, and that disastrous consequences, sooner or later, are ahead. He does not understand the spiritual effects that such an unholy relationship has upon the church body, church members individually and as families, and upon society as a whole.

Like the people of the nation Israel, not satisfied with proceeding directly under God as a theocracy, demanded and were granted a king by God, a church who is not satisfied with being solely under God will incorporate, get 501(c)(3) status, organize as a charitable trust, or become a legal entity by some other means. That church may still be blessed by God to some extent; but, like Israel (See I S. 8, 12.16-25), she has committed a great wickedness and started down a slippery slope. After taking the first step to dishonor her Husband, additional steps follow. The church and her members proceed, to a significant extent, according to earthly rules and procedures designed by the god of this world, not by Christ as given in His Word. Incremental compromises begin and continue, resulting in negative spiritual effects to the church, her members and families, and society to one degree or another. Sooner or later complete apostasy will likely result.

Unlike many earthly husbands who have been betrayed, God can and will forgive and forget if a wayward church repents and turns back to the Lord. Christ said to the church at Ephesus who had left her first love (Christ), “Remember therefore from whence thou art fallen, and repent, and do the first works; or else I will come unto thee quickly, and will remove thy candlestick out of his place, except thou repent” (Re. 2.5). How vexing to see that most men of God can understand the importance of honoring the marriage relationship between man and woman, but cannot understand the importance of honoring a more important marriage relationship.

B. Old Testament insights concerning the marriage relationship

The Old Testament offers additional insights about the marriage relationship between Christ and His churches. There God describes His feelings about the Husband-wife relationship. Israel is depicted as the wife of Jehovah God the Father who is called the Husband of Israel.

Isaiah 54 deals with Israel the restored wife of Jehovah & security and blessing of restored Israel. God the Father was the Husband of Israel. “For thy maker is thine husband; the LORD of hosts is his name; and thy Redeemer the Holy one of Israel; The God of the whole earth shall he be called” (Is. 54.5).

Hosea depicts the dishonored wife (Israel), and the sinful people. “… Plead with your mother, plead: for she is not my wife, neither am I her husband. Let her therefore put away her whoredoms out of her sight, and her adulteries from between her breasts; Lest I strip her naked, and set her as in the day that she was born, and make her as a wilderness, and set her like a dry land, and slay her with thirst. And I will not have mercy on her children; for they be the children of whoredoms. For their mother hath played the harlot: she that conceived them hath done shamefully: for she said, I will go after other lovers, that give me my bread and my water, my wool and my flax, mine oil and my drink” (Ho. 2.2-5).

Hosea 4.6-11 speaks of the willful ignorance of Israel: “My people are destroyed for lack of knowledge: because thou hast rejected knowledge, I will also reject thee, that thou shalt be no priest to me: seeing thou has forgotten the law of thy God, I will also forget my children…” (See Ho. 4).

Jeremiah 2-6 discusses the harlotry of Israel toward her Husband, Jehovah, and His warnings and promises to her depending upon whether she repents. “Turn, O backsliding children saith the LORD; for I am married unto you…. Surely as a wife treacherously departeth from her husband, so have ye dealt treacherously with me, O house of Israel, saith the LORD” (Je. 3.14, 20).

Various people in the Old Testament are types of Christ and the church, the Bridegroom and the bride. Typically, the book of Ruth may be taken as a foreview of the church—Ruth, as the Gentile bride of Christ, the Bethlehemite who is able to redeem. Rebecca was a type of the church, the “called out” virgin bride of Christ. Isaac was a type of the Bridegroom, who loves through the testimony of the unnamed Servant: “Whom having not seen, ye love; in whom, though now ye see him not, yet believing, ye rejoice with joy unspeakable and full of glory[.]” (I Pe. 1.8).

Isaac was a type of the Bridegroom who goes out to meet and receive his bride. “For if we believe that Jesus died and rose again, even so them also which sleep in Jesus will God bring with him. For this we say unto you by the word of the Lord, that we which are alive and remain unto the coming of the Lord shall not prevent them which are asleep. For the Lord himself shall descend from heaven with a shout, with the voice of the archangel, and with the trump of God: and the dead in Christ shall rise first[.]” (I Th. 4.14-16).

The coming of the Bridegroom is cause for great rejoicing by the believer, the friend of the Bridegroom (See, e.g., Jn. 3.29). The marriage of the Lamb to His bride the church will be a glorious event which will occur in heaven:

“Let us be glad and rejoice, and give honour to him: for the marriage of the Lamb is come, and his wife hath made herself ready. And to her was granted that she should be arrayed in fine linen, clean and white: for the fine linen is the righteousness of saints. And he saith unto me, Write, Blessed are they which are called unto the marriage supper of the Lamb. And he saith unto me, These are the true sayings of God” (Re. 19.7-9; see also, Re. 21.9-22.17).

C. Additional New Testament insights into the love

relationship between Christ and His churches

As we have seen, the husband is to be the only head of the wife, and Christ is to be the only Head of His churches (See Ep. 5.23-27, 29-33 quoted above). “And hath put all things under his feet, and gave him to be the head over all things to the church” (Ep. 1.22). “[Christ] is the image of the invisible God, the firstborn of every creature: For by him were all things created, that are in heaven, and that are in earth, visible and invisible, whether they be thrones, or dominions, or principalities, or powers: all things were created by him and for him: And he is before all things, and by him all things consist. And he is the head of the body, the church: who is the beginning, the firstborn from the dead; that in all things he might have the preeminence” (Col. 1.15-18).

Christ, likened unto a husband, because of His love for His churches, gave Himself to redeem them. He is, in love, sanctifying the church, and will present the church to Himself as a reward for His sacrifice and labor of love, a glorious church, not having spot, or wrinkle, or any such thing, a perfect church without spot or blemish, “one pearl of great price” (Mt. 13.45-46).

Jesus is the Father’s love-gift to the world: “For God so loved the world, that he gave his only begotten Son, that whosoever believeth in him should not perish, but have everlasting life” (Jn. 3.16).

The believer, the church member, is His reward, given Him as a love-gift by the Father. “As thou hast given him power over all flesh, that he should give eternal life to as many as thou hast given him” (Jn. 17.2). “I have manifested thy name unto the men which thou gavest me out of the world: thine they were, and thou gavest them me; and they have kept thy word” (Jn 17.6). “I pray for them: I pray not for the world, but for them which thou hast given me; for they are thine” (Jn. 17.9). “And now I am no more in the world, but these are in the world, and I come to thee. Holy Father, keep through thine own name those whom thou hast given me, that they may be one, as we are” (Jn. 17.11). “Father, I will that they also, whom thou hast given me, be with me where I am; that they may behold my glory, which thou hast given me: for thou lovedst me before the foundation of the world” (Jn. 17.24). Does not the Lamb of God deserve the reward of His suffering: a chaste virgin?

Just as a bridegroom gives gifts to his earthly bride, so Christ gives gifts to His bride, to those whom the Father gave Him. He gives her: (1) Eternal life: “As thou hast given him power over all flesh, that he should give eternal life to as many as thou hast given him” (Jn. 17.2). (2) The Father’s name: “I have manifested thy name unto the men which thou gavest me out of the world: thine they were, and thou gavest them me; and they have kept thy word…. And I have declared unto them thy name, and will declare it: that the love wherewith thou hast loved me may be in them, and I in them” (Jn. 17.6, 26). (3) The Father’s words: “For I have given unto them the words which thou gavest me; and they have received them, and have known surely that I came out from thee, and they have believed that thou didst send me…. I have given them thy word; and the world hath hated them, because they are not of the world, even as I am not of the world” (Jn. 17.8, 14). (4) His own joy: “And now come I to thee; and these things I speak in the world, that they might have my joy fulfilled in themselves” (Jn. 17.13). (5) His own glory: “And the glory which thou gavest me I have given them; that they may be one, even as we are one” (Jn. 17.22).

As Christ loves His churches, so should they love Him. Mere emotion and proclamations do not equal love. Jesus said, “If ye love me, keep my commandments” (Jn. 14.15). “He that hath my commandments, and keepeth them, he it is that loveth me: and he that loveth me shall be loved of my Father, and I will love him, and will manifest myself to him” (Jn. 14.21). “Jesus answered and said unto him, If a man love me, he will keep my words: and my Father will love him, and we will come unto him, and make our abode with him” (Jn. 14.23 ). “If ye keep my commandments, ye shall abide in my love; even as I have kept my Father’s commandments, and abide in his love” (Jn. 15.10). “Ye are my friends, if ye do whatsoever I command you” (Jn. 15.14). “For this is the love of God, that we keep his commandments: and his commandments are not grievous” (I Jn. 5.3).

What are Christ’s commandments? As has already been mentioned, the first and greatest commandment is to love the Lord with all one’s heart, soul, mind, and strength, and the second is “like unto it, Thou shalt love thy neighbor as thyself.”

D. A I Corinthians 13 analysis of the love relationship

between Christ and His churches

This love between Christ and His church and what it entails is seen in the Song of Solomon:

The Song of Solomon, “[p]rimarily, is the expression of pure marital love as ordained of God in creation, and the vindication of that love as against both asceticism and lust—the two profanations of the holiness of marriage. The secondary and larger interpretation is of Christ, the Son and His heavenly bride, the Church (2 Cor. 11.1-4, refs.)” (1917 Scofield Reference Edition, Headnote to Song of Solomon, p. 705).

“Many waters cannot quench love, neither can the floods drown it: if a man would give all the substance of his house for love, it would be utterly contemned” (Song of Solomon 8.7). “Contemned” means “despised, scorned, slighted, neglected, or rejected with disdain” (AMERICAN DICTIONARY OF THE ENGLISH LANGUAGE, NOAH WEBSTER (1828), definition of “CONTEMNED.” Unless otherwise indicated, all definitions which follow are from this dictionary.). God despises, scorns, slights, neglects, or rejects with disdain all that a church does, whatever professions of love she makes, if those acts and/or professions are without love. No matter what she says, a church who does not honor Christ as her Husband, her Bridegroom, by remaining pure and chaste, demonstrates that she does not love God with all her heart, soul, mind, and strength. Thus, loving ones neighbor by witnessing to him, sending missionaries to him, helping him materially or any other way in obedience to the second commandment—“Thou shalt love thy neighbor as thyself”—is vanity in God’s eyes if one ignores the greatest commandment.

This truth is also articulated in the New Testament. The Lord Jesus is jealous over His churches. If we do not love the Lord Jesus, He despises all the “Christian” work we do and the money we put in the offering plate:

“Though I speak with the tongues of men and of angels, and have not charity, I am become as sounding brass, or a tinkling cymbal. And though I have the gift of prophecy, and understand all mysteries, and all knowledge; and though I have all faith, so that I could remove mountains, and have not charity, I am nothing. And though I bestow all my goods to feed the poor, and though I give my body to be burned, and have not charity, it profiteth me nothing” (I Co. 13.1-3).

“In a theological sense, [‘charity’] “includes supreme love to God and a universal good will to men. 1 Cor. xiii. Col. iii. 1 Tim. i.” (definition of ‘CHARITY’). I Corinthians 13.4-8 reveals that love is an act of the will and describes what actions constitute love. A church refutes its proclamations of love for the Lord when it wholly or partially takes the church from under the headship of her Husband, the Lord Jesus Christ and/or violates any of the other attributes of love as given in those verses.

Churches who put themselves even partially under another head dishonor their Husband. Such churches, by their actions, show that they do not have a supreme love for God, that they do not love the Lord with all their heart, soul, mind, and strength. Let’s examine I Corinthians 13.4-8 verse by verse and apply it to the love of a church for the Lord Jesus Christ.

“Charity suffereth long, and is kind; charity envieth not; charity vaunteth not itself, is not puffed up” (I Co. 13.4). “Suffereth long” means that one is patient and forbearing. In other words, he waits upon the Lord. “But they that wait upon the LORD shall renew their strength; they shall mount up with wings as eagles; they shall run, and not be weary; and they shall walk, and not faint” (Is. 40.31).

“But they that wait upon the Lord – The word rendered ‘wait upon’ here (from קוה qavah ), denotes properly to wait, in the sense of expecting. The phrase, ‘to wait on Yahweh,’ means to wait for his help; that is, to trust in him, to put our hope or confidence in him….

“It does not imply inactivity, or want of personal exertion; it implies merely that our hope of aid and salvation is in him – a feeling that is as consistent with the most strenuous endeavors to secure the object, as it is with a state of inactivity and indolence. Indeed, no man can wait on God in a proper manner who does not use the means which he has appointed for conveying to us his blessing. To wait on him without using any means to obtain his aid, is to tempt him; to expect miraculous interposition is unauthorized, and must meet with disappointment. And they only wait on him in a proper manner who expect his blessing in the common modes in which he imparts it to men – in the use of those means and efforts which he has appointed, and which he is accustomed to bless. The farmer who should wait for God to plow and sow his fields, would not only be disappointed, but would be guilty of provoking Him. And so the man who waits for God to do what he ought to do; to save him without using any of the means of grace, will not only be disappointed, but will provoke his displeasure” (Albert Barnes Notes on the Bible…).

A church who loves the Lord and suffers long is patient and waits on the Lord, while using only those means authorized by Him. An incorporated 501(c)(3) church has not “suffered long.”

Charity is kind. “A man who truly loves another will be kind to him, desirous of doing him good; will be gentle, not severe and harsh; will be courteous because he desires his happiness, and would not pain his feelings” (Ibid.). A Church who loves God will not cause God pain or grief by dishonoring her love relationship with the Lord Jesus.

Charity envieth not. One who truly loves another will not envy in the bad sense; that is, he or she “will be kind to him, desirous of doing him good; will be gentle, not severe and harsh; will be courteous because he desires his happiness, and would not pain his feelings” (Ibid.).

Charity vaunteth not itself:

“The idea is that of boasting, bragging, vaunting. The word occurs nowhere else in the New Testament. Bloomfield supposes that it has the idea of acting precipitously, inconsiderately, incautiously; and this idea our translators have placed in the margin, ‘he is not rash.’ But most expositors suppose that it has the notion of boasting, or vaunting of one’s own excellences or endowments. This spirit proceeds from the idea of superiority over others; and is connected with a feeling of contempt or disregard for them. Love would correct this, because it would produce a desire that they should be happy–and to treat a man with contempt is not the way to make him happy; love would regard others with esteem–and to boast over them is not to treat them with esteem; it would teach us to treat them with affectionate regard–and no man who has affectionate regard for others is disposed to boast of his own qualities over them. Besides, love produces a state of mind just the opposite of a disposition to boast. It receives its endowments with gratitude; regards them as the gift of God; and is disposed to employ them not in vain boasting, but in purposes of utility, in doing good to all others On as wide a scale as possible. The boaster is not a man who does good. To boast of talents is not to employ them to advantage to others. It will be of no account in feeding the hungry, clothing the naked, comforting the sick and afflicted, or in saving the world. Accordingly, the man who does the most good is the least accustomed to boast; the man who boasts may be regarded as doing nothing else” (Ibid.).

The application to the church regarding attachments to the civil government is obvious to the spirit filled believer.

Charity is not puffed up (jusioutai). This “word means, to blow, to puff, to pant; then to inflate with pride, and vanity, and self-esteem. [This word the feeling expresses the feelings of pride, vanity, etc.]…. Love[, on the other hand] is humble, meek, modest, unobtrusive” (Ibid.). Pride, vanity, and self-esteem exclude God, and lead to a betrayal of God by turning to another such as the civil government.

“Doth not behave itself unseemly, seeketh not her own, is not easily provoked, thinketh no evil[.]” (I Co. 13.5). Charity “doth not behave itself unseemly” means, “to conduct improperly, or disgracefully, or in a manner to deserve reproach. Love seeks that which is proper or becoming…” (Ibid.). A church who loves the Lord will seek to abide in Christ and His principles for His churches.

Charity “seeketh not her own:”

“It means, to conduct improperly, or disgracefully, or in a manner to deserve reproach. Love seeks that which is proper or becoming in the circumstances and relations of life in which we are placed. It prompts to the due respect for superiors, producing veneration and respect for their opinions… [I]t prompts to the fit discharge of all the relative duties, because it leads to the desire to promote the happiness of all.” (Ibid.).

Churches incorporate, get 501(c)(3) tax exemption, or become legal entities in other ways in violation of their God-given duties thereby disrespecting their Highest Superior.

Charity “is not easily provoked, paroxunetai:”

“The meaning of the phrase in the Greek is, that a man who is under the influence of love or religion is not prone to violent anger or exasperation; it is not his character to be hasty, excited, or passionate. He is calm, serious, patient. He looks soberly at things; and though he may be injured yet he governs his passions, restrains his temper, subdues his feelings. This, Paul says, would be produced by love. And this is apparent. If we are under the influence of benevolence or love to any one, we shall not give way to sudden bursts of feeling. We shall look kindly on his actions; put the best construction on his motives; deem it possible that we have mistaken the nature or the reasons of his conduct; seek or desire explanation (Mt. 5:23-24).… That true religion is designed to produce this, is apparent everywhere in the New Testament, and especially from the example of the Lord Jesus; that it actually does produce it, is apparent from all who come under its influence in any proper manner.” (Ibid.).

A church who becomes a legal entity has not looked soberly at the principles concerning separation of church and state in God’s Word; and she has not governed her passions and subdued her feelings. This is true even though that church may have acted in ignorance without anger or exasperation.

Charity “thinketh no evil.” This proscription does not apply to the issue we are looking at if one interprets it to mean that one is not to think evil of another, his motives or conduct. However, a church who becomes a legal entity has definitely committed an evil act against God whether she knows it or not.

Charity “[r]ejoiceth not in iniquity, but rejoiceth in the truth” (I Co. 13.6). Iniquity means “Injustice, unrighteous-ness, … [w]ant of rectitude [rightness in principle or practice], … a sin or crime; wickedness….” Jesus is the truth (Jn. 14.6). By following man’s devises and combining Christ’s church with civil government, a church is in effect following man-made principles which are contrary to God’s precepts, committing a great wickedness or sin, and rejoicing in the fact that she is following the methods and provisions of a head other than the Lord Jesus Christ.

Charity “Beareth all things, believeth all things, hopeth all things, endureth all things” (I Co. 13.7). A church who is a legal entity is seeking to avoid bearing perceived burdens such as losing rich earthly oriented church members. She is operating outside scriptural principles so that she can enter into contracts—such as contracts to pay her pastor or others a salary (for a church to pay anyone a salary violates biblical principle. See God Betrayed)—limit liability (not knowing that in effect, she is probably increasing risk and liability rather than limiting it. See Ibid., Section VI, Chapter 6), hold property (not knowing that a church can utilize property in America while honoring biblical principles. (See Ibid., Chapter 7), give tax deductions for contributions (See Ibid., Chapter 8), and for other spurious reasons. She may be allegedly seeking to obey what she incorrectly believes is her master, the civil government (See Ibid., Section III, Chapters 5 and 6,and Jerald Finney, Render Unto God the Things that Are His (Austin, TX: Kerygma Publishing Co., 2009)). Finally, she is attempting to avoid any persecution and any adverse affects—she wants to assure her members that they will have no persecution or anything else to endure. A church who is a legal entity is not believing all the Word of God and she is not placing her hope in the Lord. At the very least, part of her hope is in civil government.

“Charity never faileth” (I Co. 13.8). A church who depends upon and subjects herself to the civil government has certainly failed the Lord.

V. Conclusion

The Lord Jesus gave a warning to the church at Ephesus:

“I know thy works, and thy labour, and thy patience, and how thou canst not bear them which are evil: and thou hast tried them which say they are apostles, and are not, and hast found them liars: And hast borne, and hast patience, and for my name’s sake hast laboured, and hast not fainted. Nevertheless, I have somewhat against thee, because thou hast left thy first love. Remember therefore from whence thou art fallen, and repent, and do the first works; or else I will come unto thee quickly, and will remove thy candlestick out of his place, except thou repent” (Re. 2.2-5).

As Dr. J. Vernon McGee teaches us, this warning was for every church who has lost her love for the Lord Jesus:

“It was a warning of danger of getting away from a personal and loving relationship with Jesus Christ. The real test of any believer, especially those who are attempting to serve Him, is not your little method or mode or system, or your dedication, or any of the things that are so often emphasized today. The one question is: Do you love Him? Do you love the Lord Jesus? When you love Him, you will be in a right relationship with Him, but when you begin to depart from the person of Christ, it will finally lead to lukewarmness. The apostate church was guilty of lukewarmness. It may not seem to be too bad, but it is the worst condition that anyone can be in. A great preacher in upper New York state said: ‘Twenty lukewarm Christians hurt the cause of Christ more than one blatant atheist.’ A lukewarm church is a disgrace to Christ” (J. Vernon McGee, Revelation, Volume I (Pasadena, California: Thru the Bible Books, 1982), pp. 121-122).

As the Lord Jesus Christ is jealous over His churches, so should pastors and church members be jealous, with a godly jealousy, over the church they belong to, just as Paul was (See II Co. 11.1-3).

The church who really loves her Husband, the Lord Jesus Christ, will seek to maintain her purity, to be subject to her Husband in all things. All the professions of love, all the good deeds, the hymns sung, and the messages preached by a church who does not totally submit herself in all things to her Husband are contemned by the Lord since that church, by her actions, shows that she does not love the Lord Jesus Christ with all her heart, soul, mind, and strength. A church who incorporates, organizes as a charitable trust or unincorporated association, takes a 501(c)(3) tax exemption, a license, an employee or taxpayer identification number, any type permit from the state, or puts herself under the state in any way, becomes an earthly legal entity subject to the jurisdiction of an earthly power, the civil government; and, in spite of any professions of love for the Lord, according to her actions, shows that she does not fully love the Lord Jesus Christ.

Note

The Simply Church Ministry helps churches to organize as New Testament churches completely out from under civil government and under God only. Should you wish to contact Jerald Finney, click the following link: Contact Jerald Finney. This is a ministry, not a business enterprise. Jerald Finney has made no profit at all in this endeavor of Christian love, but rather has expended much of his own money for God’s glory, in attempting to provide information and service for God’s churches.

All conclusions in this article are opinions of the author. Please do not attempt to act in the legal system if you are not a lawyer, even if you are a born-again Christian. Many questions and finer points of the law and the interpretation of the law cannot be properly understood by a simple facial reading of a civil law. For a born-again Christian to understand American law, litigation, and the legal system as well as spiritual matters within the legal system requires years of study and practice of law as well as years of study of Biblical principles, including study of the Biblical doctrines of government, church, and separation of church and state. You can always find a lawyer or Christian who will agree with the position that an American church should become incorporated and get 501(c)(3) status. Jerald Finney will discuss the matter, as time avails, with any such person, with confidence that his position is supported by God’s Word, history, and law. He is always willing, free of charge and with love, to support his belief that for a church to submit herself to civil government in any manner grieves our Lord and ultimately results in undesirable consequences. He does not have unlimited time to talk to individuals. However, he will teach or debate groups, and will point individuals to resources which fully explain his positions.

The author is a Christian first and a lawyer second. He has no motive to mislead you. In fact, his motivation is to tell you the truth about this matter, and he guards himself against temptation on this and other issues by doing all he does at no charge. He does not seek riches. His motivation is his love for God first and for others second. His goal is the Glory of God. Jerald Finney has been saved since 1982. God called him to go to law school for His Glory. In obedience, Finney entered the University of Texas School of Law in 1990, was licensed and began to practice law, for the Glory of God, in November of 1993. To learn more about the author click the following link: About Jerald Finney.

END

For His Glory

Jerald Finney, BBB, Historic Baptist, BBA, JD

opbcbibletrust.wordpress.com

As any good fundamental Baptist knows, Jack Hyles was a great leader. Under his leadership from 1959-2001, the First Baptist Church of Hammond, Indiana (which will be referred to as “First Baptist,” hereinafter), a fundamentalist Independent Baptist church in Hammond, Indiana which was founded in 1887, became one of the megachurches in the United States and during the 1970s had the highest Sunday school attendance of any church in the world. (Left-click: Wikipedia, “First Baptist Church of Hammond, Indiana”; “The History of the First Baptist Church of Hammond” for an brief audio presention).” First Baptist also operates Hyles-Anderson College,, and two K-12 schools, called City Baptist Schools (for children of the bus route of the church) and Hammond Baptist Schools (for children of the members of the church). Jack Schaap, Hyles’ son-in-law, succeeded as pastor after Hyles’ death in 2001 (Wikipedia).

As any good fundamental Baptist knows, Jack Hyles was a great leader. Under his leadership from 1959-2001, the First Baptist Church of Hammond, Indiana (which will be referred to as “First Baptist,” hereinafter), a fundamentalist Independent Baptist church in Hammond, Indiana which was founded in 1887, became one of the megachurches in the United States and during the 1970s had the highest Sunday school attendance of any church in the world. (Left-click: Wikipedia, “First Baptist Church of Hammond, Indiana”; “The History of the First Baptist Church of Hammond” for an brief audio presention).” First Baptist also operates Hyles-Anderson College,, and two K-12 schools, called City Baptist Schools (for children of the bus route of the church) and Hammond Baptist Schools (for children of the members of the church). Jack Schaap, Hyles’ son-in-law, succeeded as pastor after Hyles’ death in 2001 (Wikipedia). Dr. Hyles was a great teacher and preacher. His teachings and ministry were set forth as examples to fundamental Baptists everywhere. He preached, he taught, he wrote books and articles that influenced untold numbers of people. He was loved by many, hated by some: being loved as well as hated and criticized comes with being a pastor, especially a pastor of his influence, leadership ability, and views (most of which the author would agree with, having served under some powerful Baptist preachers since his salvation in 1982).

Dr. Hyles was a great teacher and preacher. His teachings and ministry were set forth as examples to fundamental Baptists everywhere. He preached, he taught, he wrote books and articles that influenced untold numbers of people. He was loved by many, hated by some: being loved as well as hated and criticized comes with being a pastor, especially a pastor of his influence, leadership ability, and views (most of which the author would agree with, having served under some powerful Baptist preachers since his salvation in 1982).

“I want you to listen to me very carefully. I’m going to tell you the main cause for divorce in our country. I’m going to tell you the main cause for church splits and church troubles in your country. I’m going to tell you the main cause for broken friendships in our country, in our church, in our land, and in your family. I’m going to tell you why sometimes even families have strained relationships. I want you to listen to me. I have no desire to preach a great sermon. I have a tremendous desire to help you. I know as I speak on the subject, ‘The Treasure is in a Field,’ that the treasure is in a field. I want to read for you my text verse. ‘Again, the kingdom of heaven is like unto a treasure hid in a field:’ notice the word hid. You’ve got to find it. You’ve got to look for it, and then it’s in a field. You’ve got to go to a field and look for the treasure. “…in a field: the which when a man hath found, he hideth, and for joy thereof goeth and selleth all that he hath, and buyeth that field.’ Now please, let me have your attention. I promise you, I can help your marriage. I can help your relationship with your friends, I speak this morning a very important message entitled, ‘The Treasure is in a Field.’” [Emphasis mine.]

“I want you to listen to me very carefully. I’m going to tell you the main cause for divorce in our country. I’m going to tell you the main cause for church splits and church troubles in your country. I’m going to tell you the main cause for broken friendships in our country, in our church, in our land, and in your family. I’m going to tell you why sometimes even families have strained relationships. I want you to listen to me. I have no desire to preach a great sermon. I have a tremendous desire to help you. I know as I speak on the subject, ‘The Treasure is in a Field,’ that the treasure is in a field. I want to read for you my text verse. ‘Again, the kingdom of heaven is like unto a treasure hid in a field:’ notice the word hid. You’ve got to find it. You’ve got to look for it, and then it’s in a field. You’ve got to go to a field and look for the treasure. “…in a field: the which when a man hath found, he hideth, and for joy thereof goeth and selleth all that he hath, and buyeth that field.’ Now please, let me have your attention. I promise you, I can help your marriage. I can help your relationship with your friends, I speak this morning a very important message entitled, ‘The Treasure is in a Field.’” [Emphasis mine.] Dr. Hyles then asserted that First Baptist church, spouses (both husbands and wives), friends, leaders, parents, and teachers are treasures; but all these treasures come with fields (sins, flaws, irritants). Finally, he concluded by preaching on the One who has no field, the Lord Jesus Christ.

Dr. Hyles then asserted that First Baptist church, spouses (both husbands and wives), friends, leaders, parents, and teachers are treasures; but all these treasures come with fields (sins, flaws, irritants). Finally, he concluded by preaching on the One who has no field, the Lord Jesus Christ. Dr. Hyles, as does any knowledgeable fundamental Bible-believing Christian, knew that divorce and church trouble were rampant when he preached his sermon “The Treasure is in a Field.” Things have only gotten worse and continue to get worse at an ever accelerated rate. The divorce rate of couples in American churches has skyrocketed and is now at 50% or more. At the same time, untold numbers of fundamental Baptist churches are betraying our Lord; abandoning the fundamental doctrines and teachings of the Word of God as well as the Word of God itself; turning to corrupted interpretations of the Bible instead of the tried and true translation; resorting to psychology and other humanistic and business devices in order to increase attendance; feeding milk instead of meat to envying, striving, divided church bodies who are not able to bear the deeper things of God; teaching and/or practicing heresy; and some are falling into apostasy. Every year, droves of fundamental Baptist preachers are abandoning or betraying the faith and scores or hundreds of fundamental, Bible-believing Baptist churches are ceasing to exist. In other words, spiritual treasure is being abandoned and lost and, sadly, very few understand why.

Dr. Hyles, as does any knowledgeable fundamental Bible-believing Christian, knew that divorce and church trouble were rampant when he preached his sermon “The Treasure is in a Field.” Things have only gotten worse and continue to get worse at an ever accelerated rate. The divorce rate of couples in American churches has skyrocketed and is now at 50% or more. At the same time, untold numbers of fundamental Baptist churches are betraying our Lord; abandoning the fundamental doctrines and teachings of the Word of God as well as the Word of God itself; turning to corrupted interpretations of the Bible instead of the tried and true translation; resorting to psychology and other humanistic and business devices in order to increase attendance; feeding milk instead of meat to envying, striving, divided church bodies who are not able to bear the deeper things of God; teaching and/or practicing heresy; and some are falling into apostasy. Every year, droves of fundamental Baptist preachers are abandoning or betraying the faith and scores or hundreds of fundamental, Bible-believing Baptist churches are ceasing to exist. In other words, spiritual treasure is being abandoned and lost and, sadly, very few understand why. “Love not the world, neither the things that are in the world. If any man love the world, the love of the Father is not in him. For all that is in the world, the lust of the flesh, and the lust of the eyes, and the pride of life, is not of the Father, but is of the world. And the world passeth away, and the lust thereof: but he that doeth the will of God abideth for ever.”)

“Love not the world, neither the things that are in the world. If any man love the world, the love of the Father is not in him. For all that is in the world, the lust of the flesh, and the lust of the eyes, and the pride of life, is not of the Father, but is of the world. And the world passeth away, and the lust thereof: but he that doeth the will of God abideth for ever.”) A couple takes the first step in the contamination of the marriage when they treat their marriage as a contract. Biblical covenant marriage is a three-way relationship, a covenant to which God is the controlling party. God’s rules and principles are all that apply to such a marriage, at least as entered into and agreed to by the parties to the covenant. State marriages are contracts and the controlling party to the contract of marriage is the state—a couple who marries under state license and contract voluntarily submit to contract or agreement and state control. If one does not believe this, the author would herein make only two of many points which verify this: (1) a civil court will not allow biblical principles into the divorce suit; and (2) in Texas, and I believe in most or all states, no reason is needed for a divorce (“no-fault divorce”). My conclusion is not affected by the fact that states will take control of any marriage, whether sanctioned by the state or not. A couple who understand and apply God-ordained covenant marriage are far less likely to see divorce through the state or by any other means, since they probably love the Lord and are taking into consideration biblical principles before marrying, and they are more likely to apply biblical principles concerning marriage and family after they marry. A spouse who marries under biblical covenant as opposed to earthly or state contract is also more likely to be aware of God’s rules and feelings concerning the marrriage relationship and therefore less likely to rebel against God by seeking a divorce.

A couple takes the first step in the contamination of the marriage when they treat their marriage as a contract. Biblical covenant marriage is a three-way relationship, a covenant to which God is the controlling party. God’s rules and principles are all that apply to such a marriage, at least as entered into and agreed to by the parties to the covenant. State marriages are contracts and the controlling party to the contract of marriage is the state—a couple who marries under state license and contract voluntarily submit to contract or agreement and state control. If one does not believe this, the author would herein make only two of many points which verify this: (1) a civil court will not allow biblical principles into the divorce suit; and (2) in Texas, and I believe in most or all states, no reason is needed for a divorce (“no-fault divorce”). My conclusion is not affected by the fact that states will take control of any marriage, whether sanctioned by the state or not. A couple who understand and apply God-ordained covenant marriage are far less likely to see divorce through the state or by any other means, since they probably love the Lord and are taking into consideration biblical principles before marrying, and they are more likely to apply biblical principles concerning marriage and family after they marry. A spouse who marries under biblical covenant as opposed to earthly or state contract is also more likely to be aware of God’s rules and feelings concerning the marrriage relationship and therefore less likely to rebel against God by seeking a divorce. God Betrayed/Separation of Church and State: The Biblical Principles and the American Application was written at the graduate or post-graduate school level for mature educated Christians who desire to understand the issue of church incorporation and 501(c)(3) status for churches and the state marriage contract for man and wife. The main empahses of the book are reflected in the outline of the book, that is, the Table of Contents. By going to the Table on Contents, one can left-click a chapter, the Bibliography, the Index, or the Index of Scripture verses and go directly to the clicked site. For example, if one left clicks Section VI, Chapter 2 “Incorporation of churches,” in the Table of Contents of the preview of God Betrayed, he will learn about the law of incorporation in America. Section VI, Chapter 7, “Spurious Rationale for incorporating: to hold property” biblically compares a legal and God-honoring manner for a church to hold property with God-dishonoring church incorporation.

God Betrayed/Separation of Church and State: The Biblical Principles and the American Application was written at the graduate or post-graduate school level for mature educated Christians who desire to understand the issue of church incorporation and 501(c)(3) status for churches and the state marriage contract for man and wife. The main empahses of the book are reflected in the outline of the book, that is, the Table of Contents. By going to the Table on Contents, one can left-click a chapter, the Bibliography, the Index, or the Index of Scripture verses and go directly to the clicked site. For example, if one left clicks Section VI, Chapter 2 “Incorporation of churches,” in the Table of Contents of the preview of God Betrayed, he will learn about the law of incorporation in America. Section VI, Chapter 7, “Spurious Rationale for incorporating: to hold property” biblically compares a legal and God-honoring manner for a church to hold property with God-dishonoring church incorporation.