Essays and article on federal tax exemption and the rules, including the Johnson Amendment, which comes with tax-exempt status:

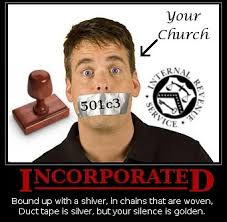

- Federal government control of churches through IRS Code Sections 501(c)(3) and 508(c)(1)(A) tax exemption (121012)

- The church incorporation-501(c)(3) control scheme (121021)

- The Rules and Regulations that Come with Church IRS Code Sections 501(c)(3) and 508(c)(1)(A) Tax-Exempt Status (031722)

- Are Churches Automatically Tax Exempt? (040822)

- A Biblical and Legal Analysis of the Helping Hand Outreach Publication, “WHY ALL CHURCHES SHOULD BE A 508(c)(1)(a).”

- Legal answer to Pastor’s inquiry concerning whether a potential donor of substantial gift an claim a tax deduction under IRC Section 508 even though the church will not give an IRS acknowledgement (123118)

- Does a Church Need 501(c)(3) or 508(c)(1)(A) Status? A Biblical and Legal Answer (062324)

- Church Internal Revenue Code § 508(c)(1)(A) Tax Exempt Status (042814)

Have They Gotten Rid of the “Johnson Amendment” as President Trump Promised?

Jerald Finney

Copyright © September 9, 2025

President Trump honors believers in the Lord Jesus Christ and wishes to return the nation to her founding principles. He is trying to clean up the federal government and rescue America from the Woke Agenda, DEI, government waste, high taxes etc. He is not afraid to confront anyone, including the United Nations assembly, with truth. Many of his appointments and advisers are believers in the Lord Jesus Christ. Remember what Kamala Harris told a person at a Democrat rally who said, “Jesus Christ is King?” She, with a condescending tone of voice and silly grin on her face said, “You belong at that smaller rally down the street?” She was letting him know that the Lord was not welcomed by the Democrats. Thank the Lord that Trump is our President.

This article, in speaking to his statements and actions concerning the “Johnson Amendment,” are not meant to demean our President.

President Trump, early in his campaign for President in 2016, became aware of the “Johnson Amendment.” He stated, in his speech at the Museum of the Bible, that it prohibits all 501(c)(3) tax exempt organizations (including churches), to whom contributions are tax deductible, from participating in political campaigns (specifically, supporting or opposing a candidate). In 2016, he promised that they would get rid it.

The “Johnson Amendment” is one of four rules in Internal Revenue Code § 501(c)(3) which religious organizations who ask for and obtain 501(c)(3) status agree to abide by. The purpose of the rule is to prevent tax-deductible money from being used to support or oppose candidates for public office. The Johnson Amendment does not prohibit all electoral activity, and 501(c)(3) organizations may still actively participate in the election process, but with significant limitations, if enforced. This article speaks to President Trump’s statements and actions concerning the “Johnson Amendment.”

He, after speaking at a board meeting to pastors and rabbis in 2016, asked for their support for president. But they did not respond. After the meeting, he was told about the “Johnson Amendment;” that because of that “Amendment” churches and religious organizations lose their tax-exempt status if “a pastor, minister, rabbi, imam, or anybody says anything about politics, you can lose your tax exempt status.” His response was, “You got to be kidding.” He said that the religious leaders were petrified about it and nobody wanted to talk about it; they became a different group of people. He pledged to them in a later meeting, “If I win, we’re going get rid of the Johnson Amendment.” He then gave an account of how the Johnson Amendment was passed. He gained their support. He recently stated that they got rid of the Amendment. See his comments by clicking here. See, Speech at the Museum of the Bible for the entire speech.

Have they gotten rid of the Johnson Amendment? The short answer is “No (with some caveats).” I answered this and related questions in a prior article: Did President Trump do away with 501(c)(3) requirements? Published on December 2, 2017. The answers in that article are still applicable.

I am not sure what President Trump believes about the matter of separation of church and state. I do know that he has some advisors who hold an incorrect view on that issue. The Trail of Blood of the Martyrs of Jesus: Christian Revisionists on Trial; The Christian History of the First Amendment explains the warfare going on in American politics from a Christian and historical perspective. Christian historical and Biblical revisionists have led the political activist fight in American politics and lead the way for Christian political activists. They have revised the true history of religious freedom and soul liberty in America as well as God’s guidelines for their activities.

President Trump does not have the time to do a thorough study of these matters to seek out the truth so that he can determine the truth of what he is told by religious people. He stated in his speech,

- “I don’t want to hear from a lot of people. We hear from the people we respect” and named some of them. He said, “All of the people that are up here, I want to hear from these people. They come from a different place than me. I come from a business place rough people, bad people, not really religious people; there are some …. That’s why we go to church on Sunday, where ever we are to listen to people of faith. …”

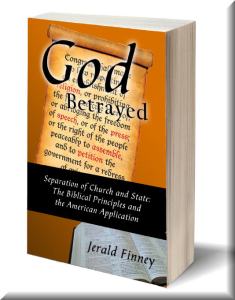

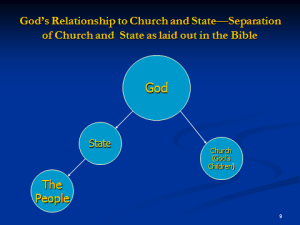

Hopefully, President Trump will not follow bad counseling on the proper relationship between church and state. God, in his word, teaches that he does not wish for church and state to work hand in hand, state over church, or church over state. God’s word does reveal that God wishes both church and state to be under God, but neither to be under, over, or combined with the other. See Part I of God Betrayed: Separation of Church and State: The Biblical Principles and the American Application for explanation. The First Amendment is consistent with God’s plan.

The Trail of Blood of the Martyrs of Jesus: Christian Revisionists on Trial; The Christian History of the First Amendment proves the truth about the true history and meaning of the First Amendment religion clause. It is not a long read and gives citations for all authorities relied upon. Read it and study it out for yourself.

TABLE OF CONTENTS OF GOD BETRAYED:

Preface……………………………………………………………….. i

Introduction…………………………………………………………. xi

PARTONE

The Biblical Principles

Section I: Government………………………………………… 1

Chapter 1: Introduction……………………………………………………………….. 3

Chapter 2: The motivation and the goal……………………………………. 9

Chapter 3: Self-government……………………………………………………… 13

Chapter 4: Family government and conscience……………. 19

Chapter 5: Civil government……………………………………………………….. 21

Chapter 6: God desires nations to choose to glorify Him………….. 27

Chapter 7: Israel—the only theocracy ordained by God…………… 31

Chapter 8: God is the God of Israel……………………………………………… 39

Chapter 9: God desires Gentile nations to glorify Him………………. 51

Chapter 10: God judges nations……………………………………………….. 53

Chapter 11: Satan orchestrates the world-system ……………………. 59

Chapter 12: Conclusion……………………………………………………………….. 63

Section II: Church………………………………………………..…..65

Chapter 1: Introduction……………………………………………………………….. 67

Chapter 2: Definition, organization, and purposes of a church……. 71

Chapter 3: Christ, the Bridegroom/Husband/Head of the church…… 79

Chapter 4: Heresy and apostasy……………………………………………….. 85

Chapter 5: Recent accelerated apostasy in the United StateS……. 93

Chapter 6: Apostasy at the end of the church age…………………….119

Chapter 7: The church will reign with the Lord…………………………121

Chapter 8: Conclusion……………………………………………….…………123

Section III: Separation of Church and State……………………………125

Chapter 1: Introduction……………………………………………………………..127

Chapter 2: Definitions………………………………………………………………135

Chapter 3: Dispensational Theology versus Covenant Theology.137

Chapter 4: Distinct differences between church and state……….153

Chapter 5: Render unto Caesar……………………………………………………169

Chapter 6: Romans 13 and I Peter 2.13……………………………………….173

Chapter 7: Christ-church, Husband-wife, Bridegroom-bride…….185

Chapter 8: Conclusion……………………………………………………………187

PART TWO

The American Application

Section IV: History of Religious Freedom in America……….189

Chapter 1: Introduction……………………..………………………………….191

Chapter 2: Secular and Christian revisionism…………………………….197

Chapter 3: The consequences of secular and Christian revisionism 205

Chapter 4: The light begins to shine………………………………………..209

Chapter 5: The Pilgrims and the Puritans in Massachusetts……..215

Chapter 6: The Baptists in Rhode Island………………………………….233

Chapter 7: The Separates and the Baptists in New England………..249

Chapter 8: From New England to the South……………………………..261

Chapter 9: To Virginia…………………….…..…………………………………….265

Chapter 10: To the new nation..…………………………..…………………285

Chapter 11: Conclusion…………………………..…………………………………..289

Section V: Religion Clause Jurisprudence………………………………….291

Chapter 1: Introduction…………………………..………………………………….293

Chapter 2: The 19th Century Supreme Court interpretation

of “separation of church and state” …………………….299

Chapter 3: Application of the First Amendment

to the states: 1868-1947…………………………..……………………….307

Chapter 4: Separation of God and state: 1947-2007………………..313

Chapter 5: Conclusion…………………………..…………………………………..345

Section VI: God Betrayed: Union of Church and State…….349

Chapter 1: Introduction…………………………..…… …..………..351

Chapter 2: Incorporation of churches………………………………………365

Chapter 3: Incorporation of churches in the colonies and the new natioNn……………………………………………………………………………………………………379

Chapter 4: Federal government control of churches through 501(c)(3) tax exemption………………………………………………………………………………..385

Chapter 5: The incorporation-501(c)(3) control scheme…………395

Chapter 6: Spurious rationale for incorporating: limited liability 401

Chapter 7: Spurious rationale for incorporating: to hold property 405

Chapter 8: Spurious rationale for corporate-501(c)(3) status:

tax exemption and tax deduction for contributions………………. 419

Chapter 9: The results of ignoring the biblical principle of

separation of church and state……………………………………………..425

Chapter 10: Conclusion…………………………..………………………………427

Bibliography…………………………………………………………431

Index………………………………………………………………….437

Index of Scripture Verses………………………………………….451

Isaiah 28:14-18 “Wherefore hear the word of the LORD, ye scornful men, that rule this people which is in Jerusalem. Because ye have said, We have made a covenant with death, and with hell are we at agreement; when the overflowing scourge shall pass through, it shall not come unto us: for we have made lies our refuge, and under falsehood have we hid ourselves: Therefore thus saith the Lord GOD, Behold, I lay in Zion for a foundation a stone, a tried stone, a precious corner stone, a sure foundation: he that believeth shall not make haste. Judgment also will I lay to the line, and righteousness to the plummet: and the hail shall sweep away the refuge of lies, and the waters shall overflow the hiding place. And your covenant with death shall be disannulled, and your agreement with hell shall not stand; when the overflowing scourge shall pass through, then ye shall be trodden down by it.”

God grieves because His people neither understand nor honor His authority and His precepts. God’s grief calls churches and believers to anguish, but few grieve, few cry, few pray, few even know that there is a call to anguish. The call started a long time ago. Authentic churches in the colonies and then the new nation, even though warned by God’s remnant, betrayed their roots and compromised the authority of God. Their betrayal passed on to future churches. The betrayal of God increased exponentially for 225 plus years to this very day. This article points out one proof of the consequences of this betrayal that should call believers and churches to anguish.

God grieves because His people neither understand nor honor His authority and His precepts. God’s grief calls churches and believers to anguish, but few grieve, few cry, few pray, few even know that there is a call to anguish. The call started a long time ago. Authentic churches in the colonies and then the new nation, even though warned by God’s remnant, betrayed their roots and compromised the authority of God. Their betrayal passed on to future churches. The betrayal of God increased exponentially for 225 plus years to this very day. This article points out one proof of the consequences of this betrayal that should call believers and churches to anguish.

In conclusion, should the IRS and/or the court decide that “Way Of The Future” is a qualified tax exempt religious organization or church, true churches will coexist as earthly legal entities alongside not only already existing corporate 501(c)(3) organizations such as Planned Parenthood, the Church of Wicca, and the Church of Satan, but also another Godless and God-defying organization which directly challenges God and His existence. Because they do not remain under their God-ordained authority (power or headship)—the Lord Jesus Christ—they will possess either no power of God or, at best, a watered down power of God.

In conclusion, should the IRS and/or the court decide that “Way Of The Future” is a qualified tax exempt religious organization or church, true churches will coexist as earthly legal entities alongside not only already existing corporate 501(c)(3) organizations such as Planned Parenthood, the Church of Wicca, and the Church of Satan, but also another Godless and God-defying organization which directly challenges God and His existence. Because they do not remain under their God-ordained authority (power or headship)—the Lord Jesus Christ—they will possess either no power of God or, at best, a watered down power of God.