Jerald Finney Churches under Christ Ministry

Contents:

Introduction

- Analysis of False Reasons Given

A. Romans 13, 1 Peter 2:13, and other verses require believers and churches to “obey every ordinance of man.

B. A church must incorporate or become some other kind of legal entity in order to hold property.

C. They want to be “practical.”

D. Answer to a Bible College Vice-President’s Article on Church Incorporation: “To Incorporate or Not To Incorporate?”

E. Links to an analysis of a variety of other false reasons (limited liability, etc.). - Links to resources which analyze and reveal the truth about other false reasons given by Pastors, some “Christian” lawyers and others for church legal entity status.

Introduction

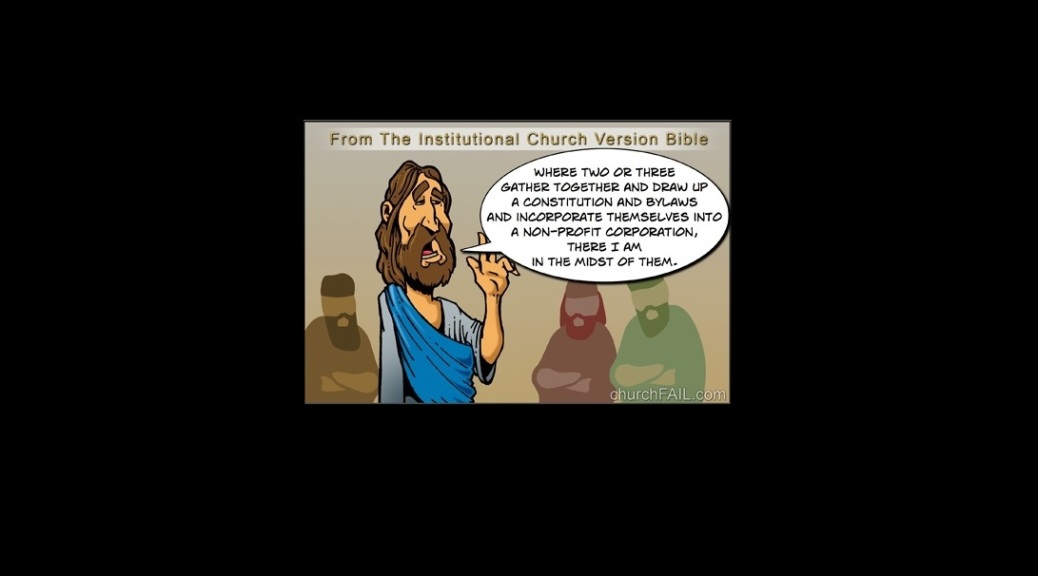

This page links to resources which analyze false reasons for betraying our Lord in church organization, goal, doctrine, and practice. They embrace and preach a social gospel, not a Bible gospel. They treat churches as businesses, according to the traditions of men as opposed to the principles of God.

Except for God’s remnant, pastors, so-called Christian attorneys, Bible College, divinity school, and seminary presidents and “professors” give a lot of excuses for violating New Testament church doctrine and example. They believe that a church in America must follow man made tradition and doctrine; that they must do things differently than did New Testament churches. They give a lot of reasons for their betrayal of our Lord:

These people claim that the modern church cannot operate Like New Testament Churches did, that churches must, for example:

A. be able to own property;

B. be able to enter into contracts, as opposed to honoring God’s relevant Bible covenants and commandments;

C. be able to go into debt;

D. organize so that the church can sue, be sued, and act legally;;

E. provide a way for members to sue—in a civil court where Bible arguments will not be heard— each other, the pastor, the church, the state, etc.;

F. limit liability of members to those who might be injured on property belonging to the church;

G. guarantee a tax deduction to those members who give to the church corporation;

H. pay the pastor a salary (make a hireling of him); I. operate like a business, using business, not Bible, methods.

Their methods include:

A.  finding out what the people in the community want (community surveys) and giving it to them in return for the people filling the corporate coffers (which they describe as building the kingdom);

finding out what the people in the community want (community surveys) and giving it to them in return for the people filling the corporate coffers (which they describe as building the kingdom);

B. providing worldly entertainment such as “Christian” rock music and concerts (which they call “worship) in a nightclub atmosphere; sports (basketball, softball, etc.) facilities and competitions;

C. orming elderly, youth, sports (basketball, softball, etc.) other groups each of which can be provided with entertainment and activities which appeal to the group;

D. teach and practice “philosophy and vain deceit, after the tradition of man, after the rudiments of the world” (they entice by advertising: “experience God, find community, fulfill your purpose”).

They claim that they must obey every ordinance of man since Romans 13 and other Scriptures require them to do so (even though the highest man made laws in America, First Amendment to the United States Constitution and corresponding state constitutional provisions, protect religious freedom and churches who wish to do things God’s way.)

1. Analysis of False Reasons Given

A. Romans 13, 1 Peter 2:13, and other verses require the believer and the church to “obey every ordinance of man.”

The primary false reason for corporate 501c3 status or related types of organization, given by many pastors and believers, is that Romans 13 (or some other verses such as 1 Peter 2.13) requires them to do so. They will say, for example, “We believe in obeying civil government as required by Romans 13.” First, no law in America requires a church to organize as an established entity, an entity under man’s law. In fact, the religion clause of the First Amendment to the United States Constitution, the highest law of the land, mandates that churches can organize any way they wish, even as spiritual entities under Christ and Christ alone according to New Testament Church doctrine.

To understand the history and meaning of the First Amendment to the United States Constitution, see The History of the First Amendment, Course on the History of the First Amendment; An Abridged History of the First Amendment.

The Romans 13 and related arguments – such as “We should obey civil government,” and “We do not want to fight civil government.” Paul, Peter, and all the apostles except John, who was exiled on the isle of Patmos were martyred because they would not bow down to civil government when the highest power, God, required them to act contrary to the rules of civil government. What about Elijah, Moses, Daniel, Shadrach Meshach, and Abednego? See the following for thorough analysies of these false arguments:

- Render Unto God the Things that Are His: A Systematic Study of Romans 13 and Related Verses (Online version, downloadable PDF, Kindle)

- Does God and/or Civil Government Require Churches to Get 501(c)(3) Status?(March 2010 essay)

- First Amendment Protection of New Testament Churches/Federal Laws Protecting State Churches (Religious Organizations)(February 2010 essay)

- Is Separation Of Church And State Found In The Constitution?(February 2014 essay)

- The Romans 13 Authority Issue (Links to various resources)

B. A church must incorporate or become some other kind of legal entity in order to hold property.

- Another Lame Excuse for Contracting with Civil Government for Church Corporate Status: Church Property Ownership (Short essay)

- Spurious rationale for church incorporation: to hold property (Longer analysis)

C. They want to be “practical.”

Many believers – in deciding church organization and doctrine – ask, “Is it pragmatic [or practical.” The question should be, “Is it biblical,” not “Is it practical” or “Is it pragmatic.” Click here to go to a sermon by Evangelist Randy Keener gives an excellent analysis of “pragmatism” versus “biblical doctrine.” Violation of the New Testament Church Doctrine sooner or later brings negative consequences for the cause of Christ. This is especially true when churches violate the principle that Christ should be the only authority over His churches and that things should be done God’s way. Look at the history and state of “churches” and “Christianity” in America, except for a small remnant, for proof. The Church as the Glory of Christ, another sermon by Evangelist Randy Keener, is also very instructive.

D. Click here to go to ANSWER TO A BIBLE COLLEGE VICE-PRESIDENT’S ARTICLE ON CHURCH INCORPORATION: “TO INCORPORATE OR NOT TO INCORPORATE?”

E. A variety of other false reasons

are examined in Separation of Church and State/God’s Churches: Spiritual or Legal Entities? The reasons examined in that book are:

- Spurious rationale for church incorporation: limited liability/incorporation increases liability of church members

- Spurious rationale for church incorporation: to hold property

- Spurious rationale for church corporate-501(c)(3) or 508(c)(1)(A) status: tax exemption and tax deductions for contributions OR Tax reasons given for church corporate 501(c)(3) or 508(c)(1)(A) status: a biblical and legal analysis

- Spurious rationale for church corporate-501(c)(3) status: one’s convictions

- Spurious rationale for church corporate-501(c)(3) status: winning souls is more important than loving God/The Most Important Thing: Loving God and/or Winning Souls?

2. Resources which reveal the truth about false reasons given by “Christian” lawyers for church legal entity status:

- More lies of “Christian” law firms and lawyers concerning church organization and the common law trust as a means of establishing a church under Christ alone outside civil government law (021120). Some “Christian” lawyers and law firms are eager to explain to inquiring pastors why a church common law trust is not Bible way of organizing a church under Christ alone and the necessity of church legal status (church organization as a non-profit corporation, charitable trust status, business trust status, Internal Revenue Code Section 501(c)(3) or 508(c)(1)(A) status, etc.). This paper clearly proves to the open minded believer who will study it out that those firms and lawyers do not have any understanding on these matters.

- Click here to go to the answer to a question regarding a lawyer’s false statements concerning church corporate 501(c)(3) status on September 22, 2018

- My reply to pastor teaching on Matthew 16.18 and Ephesians 1.22 thereafter questioned by accountant about church non-taxable status and the First Amendment (011419)

- Legal answer to Pastor’s inquiry concerning whether a potential donor of substantial gift can claim a tax deduction under IRC Section 508 even though the church will not give an IRS acknowledgement

- Believe it or not, another false reason by some unlearned believers for church establishment (corporate, 501(c)(3) or 508(c)(1)(A) tax exempt status, charitable trust status, or any church status created, defined, and controlled by man’s law) is: “The Bible does not say that a church should not incorporate, get tax exempt status, or organize under man’s law.” Another pastor stated the same argument in a different way this way: “We are Bible believers. If the Bible says do not do something, we do not do it.” The following short essay addresses that frivolous argument: According to the Bible, God Grieves when a Church Chooses to Organize Under Any Law of Man (Non-Profit Corporation Law, Federal Tax Exempt Law, Charitable Trust Law, Etc.).

- A Biblical and Legal Analysis of the Helping Hand Outreach Publication, “WHY ALL CHURCHES SHOULD BE A 508(c)(1)(a).”

- The False and Misleading Teachings and Advertisements of StartChurch, Another Spiritual and Legal Deceiver (091212)

- More StartChurch deception: Every church member can be sued if the church is an unincorporated association. Therefore, every church should incorporate. Wrong. (091322)

- Questions and Answers on Various Topics (Starting 070118)

- Answers to Letters and Questions from Pastors and Others (Before 070118)