Pastor Brian Stewart

bd92@icloud.com; usmcrev@gmail.com

812-369-1046

The Simply Church Ministry worked with Pastor Brian Stewart and Baptist Church of Monroe, in Bloomington, Indiana, as they organized the church according to God’s New Testament principles. Pastor Stewart and BCM determined that they would follow God’s guidelines in church organization and conduct no matter the cost. Fortunately, in America, churches can do things God’s way without persecution by civil government. Pastor Stewart and BCM are not afraid to apply God’s principles and shed the light of God’s truths, including His truths concerning church organization.

Simply Church hosted a Zoom meeting featuring Pastor Stewart on April 30, 2024. The link is below. Get to know him, his testimony, his discovery of God’s principles for church organization and how to implement those principles after decades of serving as a pastor. More meetings will follow and be linked to when completed.

Pastors of local churches in America face problem after problem, each a symptom sprouting from a root cause below the surface. Without digging out and killing the root, the problems will continue to spout, ever bigger and more destructive to God’s purposes. Few churches ever know about and get to the root of their problems. Brian Stewart will share his thought processes as a pastor who experienced this saga, found the underlying problem and rooted it out.

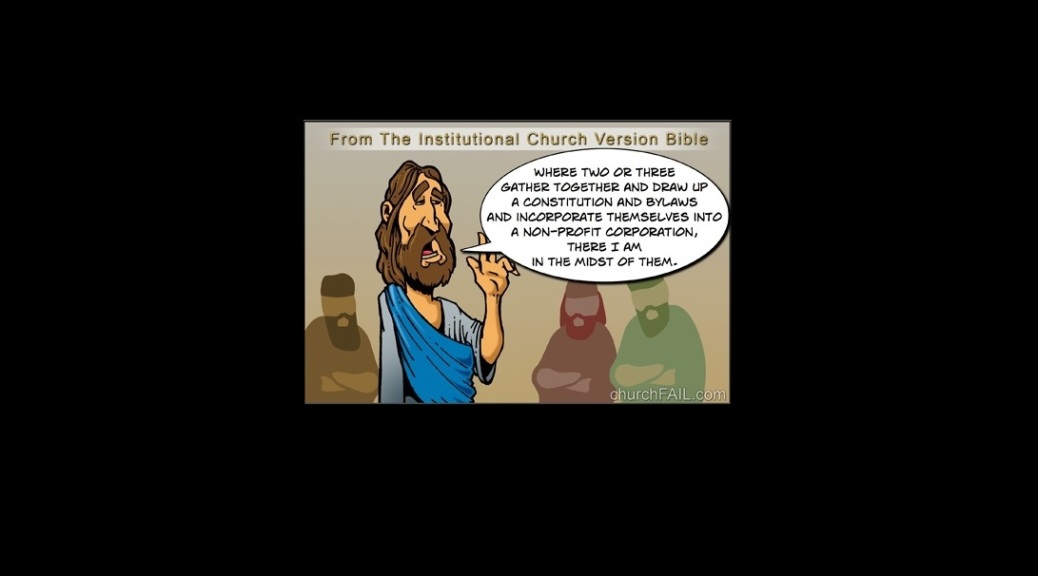

In a series of videos, Pastor Stewart will explain the journey of Baptist Church of Monroe from corporate 501(c)(3) church with three heads to New Testament Church with one head, the Lord Jesus Christ.

From Corporate 501(c)(3) Church to New Testament Church, Part 1: Introduction. April 30, 2023. See Endnote 1, for the summary of the meeting. Excerpt from Endnote 1: “Problems arose within the corporate church. For example, some church members wanted to follow the corporate constitution and bylaws and some wanted to follow the Bible….”

From Corporate 501(c)(3) Church to New Testament Church, Part 2: Getting to the source of the recurring problems of most churches in America. May 7, 2024 at 8 p.m. See Endnote 2 for a synopsis of the meeting.

Upcoming: Overview of Simply Church Trust Documents. May 14, 2024 at 8 p.m.

Future meetings with Pastor Brian Stewart will cover topics such as:

- The way of this route: How a church organizes according to New Testament Church doctrine.

- The profound is in the simple: Fixing symptoms rather than the root problems.

- The positives of going this route including “What are the top 5 or 10 areas of ministry for the church body and their priority according to God in His Word?”

- The results of going this route.

- Characteristics of the spiritually dead (the lost), spiritual infants, spiritual toddlers, spiritual children, spiritual young adults, and spiritual parents. In other words, those with whom one deals in church affairs.

Endnotes

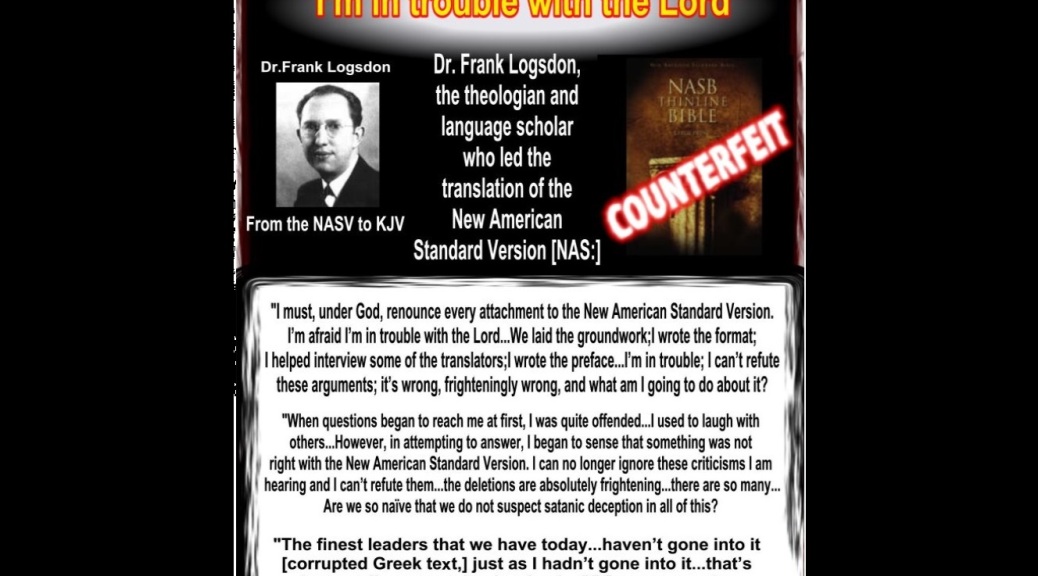

En 1: This was the 1st Zoom Meeting hosted by the Simply Church Ministry. Pastor Brian Stewart speaks for the first 34 minutes. Then there is a very enlightening question and answer session. Pastor Stewart of Baptist Church of Monroe (Indiana) shares his testimony of salvation, preparation for the pastorate, and the story of the repentance and transition of BCM from a church (civil government church) organized according to church tradition to a church organized according to New Testament principles. He lays the foundation for organization according to God’s principles, not according to personal preference based upon tradition and Satan’s deceptions which results in Satan being, at least partially and sometimes wholly, at the head. He develops the principle that simplicity in Christ is what God desires for us; but that we have complicated matters by departing from God’s principles. He thought he was leading a church that Christ was the head of, even though incorporated and 501(c)(3). He frequently emphasized to the church that Christ was head of the church. However, Problems arose within the corporate church. For example, some wanted to follow the corporate constitution and bylaws and some wanted to follow the Bible when the two were inconsistent. Then he started looking deeper into incorporation and 501(c)(3). Pastor Stewart relates the answers of church members to his question on how they felt about having executed documents declaring and establishing the church as a church under Christ alone. Etc.

Questions answered in the question and answer session include:

- 42.22 mark: Were you (Pastor Stewart) looking for a fight?

- 44.59 mark: Has the fact that the beneficiary is the Lord Jesus Christ met any resistance or caused any problems in that it is required that the beneficiary be alive?

- 1:06.36 mark: What about malfeasance by the trustee? Answer by Jerald Finney followed by perfect answer by Pastor Stewart.

- What would the church do if someone from the prior incorporated church caused problems concerning the ownership of the property used by the church?

- 1:16-1:20 mark: Some facts about the pastor: his income, responsibilities, etc.

- 1:21.42 mark: Did the trustee have to record or file the Declaration of Trust with the county or state, regarding spreading the light regarding church organization under Christ, the church relationship to government, what the documents explain to the world, every church member gets a copy of the documents, what the trustee experienced getting the religious property tax exemption and why it is OK to do so according to God’s principles, the Certification of Trust required by the bank (in Indiana) for the bank account for banking purposes only (a trust account owned by Jesus Christ, not a church checking account), what happens when something happens to the trustee, real example of corruption in a corporate church.

- Other things touched on: silencing of churches during Covid; any church attachment to government; control of church by the government; the church is the people, not the property.

En 2: Pastor Stewart begins with a short encounter he had the day before this video was made with a bank teller regarding the trust bank account. The bank teller himself understood that the account was individual, not business. Then, from God’s Word, he explains more on church order and the preeminence of Christ. The head, Christ, needs to be connected to the body in order to have control of the body. As pastor of a corporate 501(c)(3) church, he did not see these things and how they could be. Problems kept sprouting up because they were connected to a deep root. He began to understand that he was not getting to the root of the problems.

Then he found the root of the problems: the church was not rooting in Christ alone, but in the philosophies of the world, the rudiments of the world and not in Christ. To be in God’s order, a church must be organized in love under Christ alone.

So he, and the church began to learn and grow. He had to learn the law side and the Scriptural side. Once he was in command of the principles, it was his duty as pastor to teach the concepts to the church, which is the people in the assembly, convince them, and them being willing to obey. He started with the biblical principles, then got into the application. Once the body was convinced of these matters, it was time to apply them to their situation. The process was long and drawn out. He waited for the people to study it out and be the driver.

This whole matter has caused the church to trust the Christ more.

He then shared more comments from church members; he had shared some in the first meeting.

Then came a question and answer session. Matters which he addressed included:

- Being a light to other pastors and churches and how to do it God’s way so as not to stunt the growth of others whille allowing the Holy Spirit to teach others as we shed the light.

- How he discipled the church on Bible study and how this gave those who were not a reason to do so.

- Etc